What You Need To Know About Section 179 Deduction and Bonus Depreciation for the 2025 Tax Year

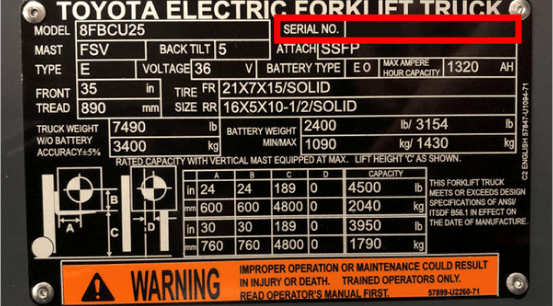

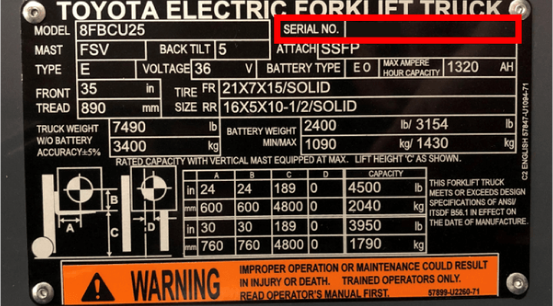

Thinking of purchasing a new Toyota forklift? This may be the time to shop. Thanks to recent updates to federal tax law, there may be additional financial incentives for investing in new equipment beginning in Tax Year 2025.

Recent tax updates announced through the One Big Beautiful Bill Act may provide you the opportunity to take advantage of an increase to the Section 179 Deduction, or the restoration of 100% Bonus Depreciation, if purchasing eligible new and used equipment during Tax Year 2025. Eligibility for these updates to equipment depreciation could mean more savings for your business!

How Does Section 179 Work?

Businesses typically write off eligible equipment in stages throughout its depreciation cycle. Through the increase in Section 179 Deduction, eligible customers can now write-off qualifying purchase amounts up to $2.5 million; this increased deduction limit is effective for property placed in service after the 2024 tax year.

With the ability to accelerate depreciation expenses, eligible customers may qualify for a reduction to their current tax liability. Some taxpayers may even be eligible to write off the entire cost of a qualifying equipment purchase in the first year. Please consult your tax advisor to determine if you qualify and if this deduction is right for you.

What Is Bonus Depreciation?

Bonus depreciation is a tax incentive that allows qualifying businesses to immediately deduct a portion of the cost of eligible assets in the year they are placed in service, rather than spreading the deduction over the asset's useful life.

- Bonus depreciation allowance has been restored to 100% effective for qualifying assets placed in service after January 19, 2025.

- Bonus depreciation applies after Section 179 deductions.

How Much Money Can I Save?

Please consult with your local tax advisor for more information on eligibility and the specific benefits of these recent tax updates for your business. Savings under Section 179 Deduction and Bonus Depreciation depend on, among other things, each company’s individual eligibility, the quantity, purpose and type of property being purchased, etc.

Is There A Deadline?

To take advantage of Section 179 for Tax Year 2025, eligible customers must purchase, finance, AND put qualifying equipment into service by December 31, 2025.

Does all Toyota Forklift Equipment Qualify?

Eligible property under Section 179 Deduction or Bonus Depreciation includes certain tangible property, like forklifts, used in a business or income-producing activity. Consult your tax advisor for more information on qualifying equipment.

Are you ready to purchase new equipment and take advantage of year-end tax savings? Reach out to your local Toyota forklift dealer for questions on how to start your next Toyota forklift purchase.

Disclaimer: This article/blog is for informational purposes only and is not tax advice. TMHNA and TICF urge all business owners to consult with their local tax or accounting advisor for more information on eligibility and the effect of Section 179 and Bonus Depreciation on their business.

Please refer to additional Information at IRS.gov: Publication 946, How To Depreciate Property | Internal Revenue Service (irs.gov)